-

What Is FOB Shipping?

In shipping, the term FOB means ‘Free on Board’ ✔️ and refers to a popularly used Incoterm. It’s usually the best way to control your shipping costs.

In shipping, the term FOB means ‘Free on Board’ ✔️ and refers to a popularly used Incoterm. It’s usually the best way to control your shipping costs.

Incoterms are essentially rules for International Trade; they allocate the division of responsibility between the Shipper (usually the supplier) and the Consignee (usually the buyer) in the process of shipping the goods from one to the other. There are many Incoterms, however, FOB trade terms are one of the most widely used to import products from Asia to the UK.

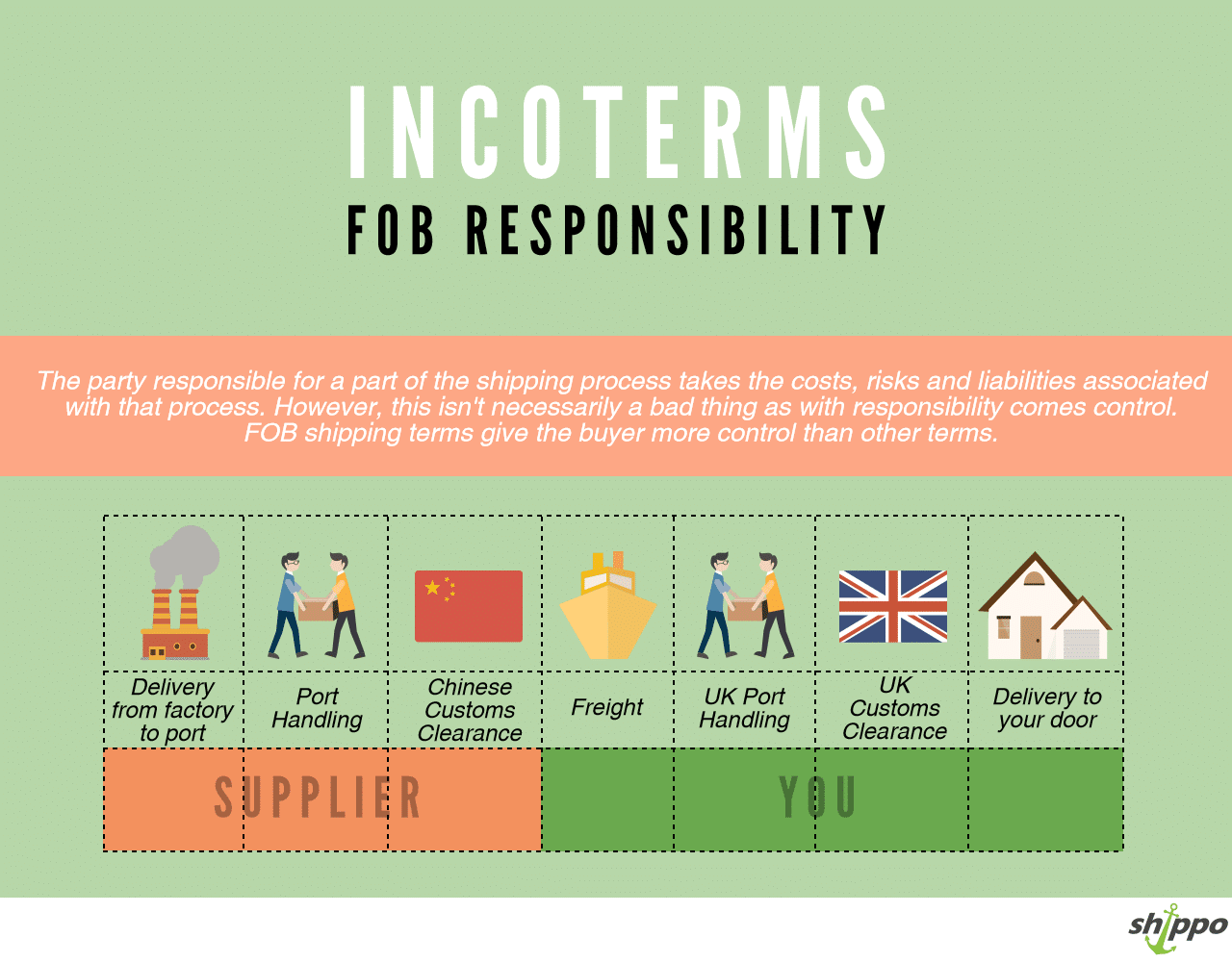

Under FOB shipping terms, the seller is responsible for all costs involved in the process up until the goods are on a vessel at the designated port. Once goods have been loaded onto the vessel the buyer is responsible for any costs and risks involved in the onward shipment.FOB Definition and Meaning

Using FOB shipping terms means the costs, risks and responsibilities are split fairly equally between the buyer and the seller of goods. On FOB terms your supplier is responsible for paying all the costs involved with your shipment until the goods are on a vessel at their outbound port. FOB Shanghai, for example, would mean that your supplier is responsible for goods until they’re loaded on the vessel at Shanghai. After this point, the responsibility then shifts to you.Explainer Video

Save

-

FOB Shipping Terms | My Responsibilities

As the buyer, you are responsible for all the costs once the goods are loaded onto a ship (or plane) in their country of origin, to the arrival of the goods at your door in the UK. You are responsible for the transport cost once the goods are on the water.

The terms of FOB normally includes a reference to a port. This is the port from which the seller will ship the goods. If, for example, your supplier offers “FOB Shanghai” terms then they expect your responsibilities start with the freight element from Shanghai to the UK. The port is not always the closest one to the seller’s premises as costs and export licences required for each port can differ. The costs vary from different ports, some are more expensive than others. See our page on which ports are most cost-effective here.

When we quote on a shipment, it will be based on FOB terms as standard. If your supplier sells you the goods on FOB terms, and you have a quote from us… you’ve got all of the transport costs covered. All there is to look into now is the Duty and VAT. You can work it out here.

Shippo; fob shipping point, trends

-

FOB Shipping | My Supplier’s Responsibilities

When buying goods on FOB Shipping terms, your supplier’s responsibilities stretch a lot further than simply transporting the goods to the port of loading. This is an issue that constantly pops up, so we thought we had better explain it.

On these terms, your supplier covers all costs to get the goods onto the vessel and our quote covers everything from that moment onwards all the way to delivery at your specified address. The costs your supplier has to cover are:

Document fees – These are the costs to produce all of the shipping documents for your goods.

Entry Summary Declaration (ENS) – The cost paid by your supplier when declaring the goods to the shipping line. This must be submitted by 5 days before the closing date, or your goods will have to wait for the next UK bound vessel.Terminal Handling Charge – This is the cost of loading your goods at the port. If this is not paid your goods will not even make it into a container, let alone on board a vessel. Once your goods are loaded into a container (by hand or by fork-lift) they must be lifted onto the vessel by cranes.

Licence fee – Your supplier has to have specific licences to export products, if they do not have this then they will pay a fee each time they export goods.

Customs clearance – When goods are cleared through customs in the country of origin, a customs clearance agent is needed who will bill for their services and any costs from the local customs that may be incurred.

Transport costs – The costs to truck your goods to the chosen outbound port is also included, but as you can see it is far from the only cost.

Telex release – As technology has moved on, you will very rarely receive your shipping documents through the post. The most common way to receive them is via an electronic release. This is also billed to your supplier. Without the Bill of Lading to state you own the goods, you will not be able to receive them.

Any other local charges – On occasion, the customs officer in the country of origin will want to inspect the cargo or may query something on the paperwork. If, for example, your supplier accidentally makes a mistake when declaring the goods, and customs request a re-submission then your supplier will also have to cover this cost. This works the same if there is a customs inspection or the goods had to be stored for any reason. If you were buying on Ex-works terms, all of these costs would be your responsibility.

Shippo; what is fob shipping, trends

To view our infographic – Click Here

-

The Costs of FOB Shipping Terms

We can give you an exact rate for your shipment to make your calculations simple but here’s what you’ll be paying for when you ship on FOB terms:

-

-

Your Supplier’s Invoice

It’s important to remember that, although it will be your supplier who’s responsible for the cost at their end, it is you who will pay it in the long run. The supplier will sell you the goods on FOB terms and will take their local shipping fees into account and include them in your invoice – but you won’t receive any nasty hidden fees, so you are able to budget up-front.

-

Sea (or possibly Air) Freight

When you import on FOB shipping terms, you’ll pay for the main transportation of your goods from the country of origin to you, whether that’s by sea or air freight. You will typically need to find a freight forwarder such as ourselves to manage your shipment.

Not sure what a freight forwarder is? Freight forwarders explained!

-

Port handling at destination

As the buyer, you will be responsible for all the UK charges, these start with having the container removed from the ship and unpacked ready for delivery.

-

Customs clearance at destination

Whenever you import goods to the UK, you will need to declare your goods to the authorities and pay the UK Duties and Taxes to UK customs. These costs can be large so investigating how much they’ll cost in advance is worthwhile, we can help you with this.

-

Delivery to final location

The final piece of the jigsaw! You’ll have to pay for the transport from the port of arrival in the UK to your door. Again, we’ll include this in your rates but how and when you need delivery to be made is certainly something to consider.

-

When using FOB for transportation, all your (foreseeable) costs are laid out in front of you before you commit to the process. Other shipping terms don’t offer this and so are much more difficult to effectively budget for.

-

What Does FOB Price On Alibaba Mean?

More seasoned exporters in the Far East will offer FOB shipping terms as standard. A quick search on Alibaba shows that sellers are encouraged to offer an “FOB Price” to potential customers so everyone knows where they stand.

The FOB price on Alibaba takes the supplier’s local shipping costs into account when calculating unit prices. Due to this, FOB unit prices are higher than the cost of the product alone but there is less risk of a nasty surprise later on in the negotiations!

FOB prices on Alibaba mean the exact same thing as FOB shipping terms do – your supplier pays all the charges until your goods are on board the vessel at the designated port. The only difference is that, when buying using the Alibaba FOB price, instead of being required to compensate the supplier for these charges through an invoice the additional fees are already included in the unit price.

FOB Shipping Terms | My Suppliers Costs

As mentioned throughout, using FOB terms can be a very straightforward way of importing goods from China to the UK. While most suppliers found on Alibaba and the like offer ‘FOB’ prices for their products, you may find them back-peddling on this saying that they need to add the FOB costs to your quote! Although not ideal, this does happen from time to time and while not totally upfront of the supplier don’t let this alarm you too much.

The FOB costs may move slightly from time to time, but should always be in a similar region. Some costs are calculated on a ‘per cbm’ basis and some are fixed. Below are some examples of FOB costs that your supplier will have to pay:

Based on an LCL shipment (all in USD$):

Documents Fee This is for the creation of the shipping documentation and costs around $50-80 Port Handling Generally around $10-15 per cbm ENS EU Regulations require Entry Summary Declarations (ENS) are lodged for inbound cargo, this generally costs $25 Customs Clearance Costing around $60 this is for the export declaration to the Customs in the country of origin Export Licence Fee Your supplier may already have one but if not, depending on the products, an Export Licence can cost anything from $50 Pick Up Fee Depends on the shipment size and the collection location but generally between $100-250 Telex Release Fee The electronic transfer of the official shipping document (Bill of Lading) to you to transfer control of the goods, this costs around $35 Based on a full 20ft container :

Documents Fee As with the LCL this will be around $80 per set. ENS approximately $25. Seal Fee Containers must be sealed for transit, and as the sole ‘tenant’ you are responsible for all costs… including this. Expect around $10. Handling Fee $50 is included in the price of a full container for handling. This is the charge from the overseas agent to make the arrangements Telex Release The telex release fee is fixed at around $35. Pick Up Fee Obviously, lugging a large container around bears greater costs than an LCL collection. This is around US$400 – 750 /20’DC Port Congestion Fee Expect around US$15 per shipment in port congestion fees. This surcharge from the lines covers losses from container congestion. The above are just a few examples of figures and are not set. These are however the costs you could work on if you’re supplier is telling you that it’ll cost thousands in FOB costs! Haulage fees will be based on the distance between your supplier and the port, so if you want to save… Try a supplier who neighbours a major port!

Shippo; fob meaning in shipping, trends

-

-

Comparing FOB Shipping Terms

FOB VS Ex Works Shipping Terms

Ex works shipping terms are another widely used incoterm. On these terms you as the importer are responsible for all costs from your supplier door, to your address in the UK. These are the second most commonly used term, and are another great way to ensure your import costs are transparent.

Our shipping terms showdowns allow you to directly compare two shipping terms that can be used when importing cargo via sea freight to the UK. In this head-to-head we look at FOB and Ex Works shipping terms.

FOB and Ex Works terms can both be used to ensure you know all of your costs from the start of the shipping process all the way up to receiving your goods. Ex Works terms leave all responsibility and risk in the hands of the buyer, whereas FOB terms split the responsibility down the middle.

FOB Advantages

- Manage your costs without hidden extras throughout the process

- Your supplier should know the export documents they need for their products

- Most sellers work to FOB terms as standard

Ex Works Advantages

- All costs are outlined from the outset

- Very rare to incur extra costs

- Cost of goods is seemingly less

FOB Disadvantages

- Seemingly increases the cost of goods

- Your supplier could add a margin to their FOB costs

Ex Works Disadvantages

- You are responsible for all risks from your suppliers premises to your door

- Costs not as clear without investigation

- You are liable for any costs incurred at customs for incorrect declarations by your supplier

There are positives and negatives for both shipping terms and this showdown does not have a winner by knockout, it’s definitely a judge’s decision! At Shippo we believe FOB shipping terms are the advisable option for a first time importer shipping goods to the UK via sea freight. This is because both you and your supplier know what’s required of them from the outset and you can get a simple quote from us and your supplier that includes all you need. Ex Works can be almost as simple but there is slight uncertainty when you are negotiating with your supplier as to the exact export documents you’ll need to clear the goods through the local Customs.

As a judge’s decision you may choose Exworks terms as the winner and if this is the case your shipment can be organised just as easily by us here at Shippo. Just give us a bit of extra time to establish the exact costs whilst our agent checks out the requirements in China, India, Taiwan or wherever your cargo is shipping from.

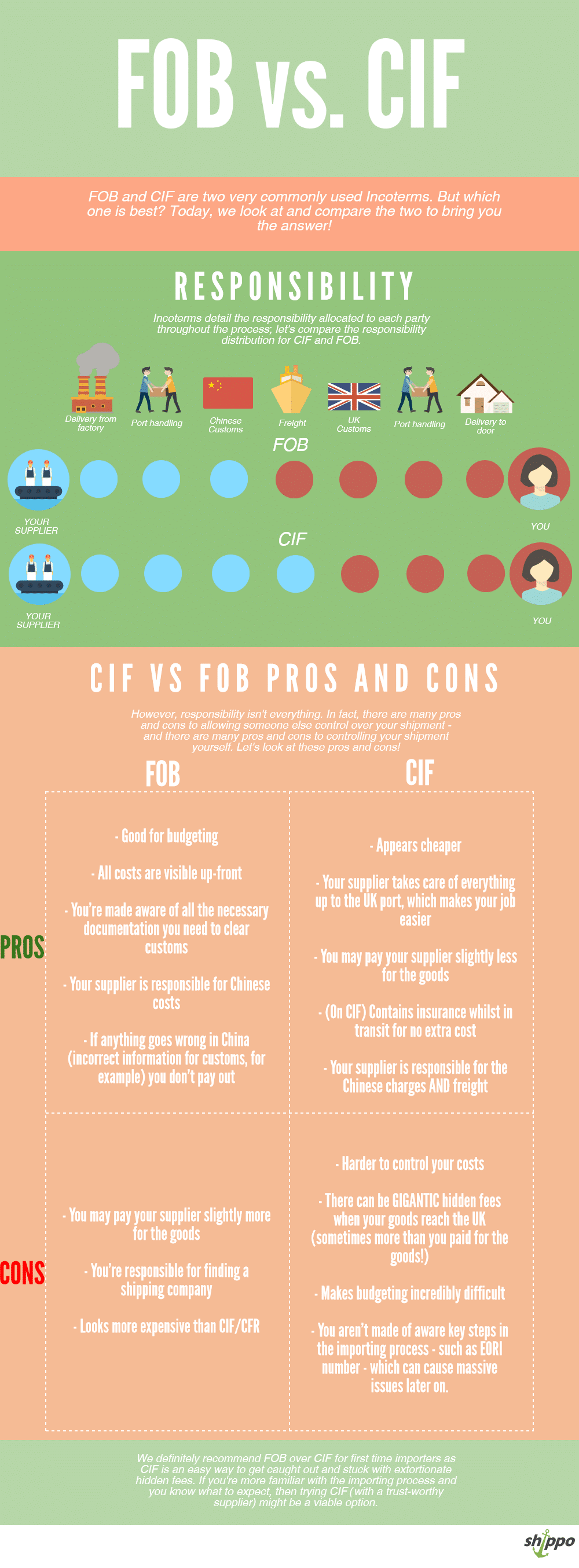

FOB VS CIF/CFR Shipping Terms

A common dilemma when importing cargo via sea freight into the UK is the question of which shipping term to use. CIF/CFR terms are also common shipping terms that your suppliers may offer.

Quick note to avoid confusion: CIF and CFR terms are exactly the same, except that CIF comes with minimal marine insurance included whereas CFR doesn’t.

CIF/CFR are Incoterms wherein your supplier is responsible for your goods until they reach the destination port. An example of this would be: if you were importing to Southampton Port, your supplier would be responsible for your goods until they reached Southampton.

When using both CIF and CFR shipping terms the seller’s invoice includes the cost of the goods, and the freight to send them to the agreed country. The seller pays for everything up to and including the freight to a named destination port, the first charge to the buyer is the terminal handling at the destination port. Both CIF and CFR terms are used successfully by many shipping companies, importers and exporters but they are not without their risks.

This is something we’ve seen many times! One of the largest risks of CIF is that it appears so easy – with FOB shipping terms, you’re fully aware that you’re importing and you’re actively a part of the process, but with CIF shipping terms it appears almost as simple as normal shipping. Your supplier is responsible for your goods for the most part – so you’ll only have to pay for customs and to get them delivered from the port, right?

Wrong.

When first-time importers ship using CIF, they are often caught with their trousers down because they aren’t aware of some of the essential steps in the importing process. One such thing we commonly see is the lack of an EORI number – many first time importers aren’t aware that you need an EORI number to be able to import to the UK, so when their goods arrive and they don’t have one . . .

Well, they’re stuck, aren’t they?

These terms can look appealing as your supplier may say that they can get your cargo to the UK port for less than to the Chinese port! Unfortunately, there’s no such thing as a free lunch (certainly not in the world of shipping) and you are likely to be hit with large hidden costs when the goods land in the UK.

FOB Advantages

- You can control your costs from the factory to your door.

- No hidden charges.

- Your supplier should know the export documents they need for their products.

- Most sellers regularly work to FOB shipping terms

CIF Advantages

- Cheaper shipping costs (until the goods land in the UK)

- Seemingly cheaper goods

- Can work well for full container loads if you have had previous success with this supplier

FOB Disadvantages

- Seemingly increases the cost of goods.

- Looks more expensive shipping than CIF/CFR

CIF Disadvantages

- There can be hidden charges (handover charges etc.)

- You may be hit with Chinese import service fees. (CISF)

- There can be problems at customs due to lack of the correct clearing requirements.

- Costs are not being managed effectively from start to finish.

As with most shipping terms there are advantages and disadvantages, however some terms are better suited for different shipment types. For first time importers, it is important that your costs are managed and outlined from the get go. For this reason, FOB terms will almost certainly be the best option over CIF or CFR.

Save

-

The Benefits of FOB Terms

If you are concerned about keeping the shipping cost under control then the best way to do so is by buying your goods on FOB shipping terms.When arranging the shipping on FOB terms for importing, the buyer can control their costs as unexpected or hidden fees are visible/avoided from the outset. These can include problems with export licences (a possible Exworks issue) or handover charges (a possible CIF issue).

On FOB terms, all overseas responsibilities belong to the shipper (your supplier). Therefore, if there is a customs inspection due to a wrongful declaration it will be billed to the guilty party (the shipper/declarant) rather than you being hit with this cost.

More seasoned exporters in the Far East will offer FOB shipping terms as standard. A quick search on sites like Alibaba show that sellers often show the “FOB Price” of their goods so everyone knows where they stand. If the seller isn’t offering FOB terms the buyer can ask for them. If you have to ask for FOB terms the seller will probably add an extra charge to the agreed sale price. This reflects their increased costs but will not increase your total shipping cost as it’s just shifting some costs from you to them.

Shippo; fob shenzhen, trends

Additional FAQ’s asked and answered by Shippo

What is the difference between FOB and CIF?

The difference between FOB and CIF shipping is the point at which responsibility for the shipment is passed between the seller and the buyer. When shipping on FOB (Free On Board) shipping terms, the supplier pays all the costs in the country of origin and the buyer takes responsibility once the goods are on board the ship. CIF (Cost, Insurance, Freight) shipping terms means that the supplier gets the goods to the buyer’s destination country with insurance included before the responsibility is transferred to the buyer. Costs are easier to control on FOB terms.

What is the difference between FOB and DDP?

The difference between FOB and DDP shipping terms is who is controlling the shipment. On FOB (Free On Board) shipping terms the buyer is responsible for the shipment from the goods being loaded onto the ship in the country of origin. DDP (Delivered Duty Paid) terms mean the seller will deliver the shipment to the location requested by the buyer and pay all the destination country’s duties on the buyer’s behalf. DDP is generally more expensive as there’s more risk for the seller.

(Click Question below to see our Answer)

For more information about Free on Board shipping call us now on 0203 384 0498 or use the chat facility above for a detailed explanation and advice on your shipping options.

We can give you an exact rate for your shipment to make your calculations simple but here’s what you’ll be paying for when you ship on FOB terms:

We can give you an exact rate for your shipment to make your calculations simple but here’s what you’ll be paying for when you ship on FOB terms: