Reviewed for accuracy on 15/11/2024

Postponed VAT Accounting is a scheme put in place by the government originally bought in after Brexit to help businesses with cash-flow. This is because it also helps with moving goods between the EU and the UK. This blog will explain what it is and how you can apply for it.

What is PVA?

Postponed VAT accounting means the VAT on your import is postponed. Therefore, instead of paying the Import VAT on arrival of your goods, you pay and reclaim your VAT in the same VAT return so there is nothing to pay on arrival of your products.

This means the goods (subject to customs clearance) can enter free circulation into the UK without the need for an upfront payment of VAT.

Therefore saving you thousands of pounds in cash flow throughout the year.

Who Can Apply?

As long as your business is established in the UK and you are VAT registered, you can apply for your imports to be declared under the PVA scheme.

Your EORI number needs to be updated so it is linked with your VAT number to ensure your imports are being declared correctly.

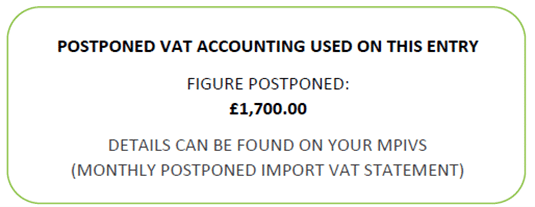

The amount of VAT applicable on each import will be detailed on your invoice (but not charged) as shown below. With PVA you will no longer receive a C79 form but instead have access to a monthly schedule of imports (MPIVS) available online.

How Can I Use PVA?

If you’re looking to declare your imports under the PVA scheme, let us know and we will send across a form to fill out. This asks whether you would like to use PVA for all shipments, specific shipments or none. We will also ask you to confirm your VAT status and confirm authorisation to declare your goods to HMRC on your behalf.

To check if you are eligible for the PVA scheme, please find HMRC’s guidance here.

How Do I Complete My VAT Return With PVA?

You will need a copy of your MPIVS which details the total VAT postponed from the previous month.

You’ll then need to complete boxes 1, 4 & 7 on your VAT return:

Box 1: Include the VAT due on goods imported during this period declared under PVA – this will be detailed on your MPIVS.

Box 4: Include the VAT reclaimed on the imports that you have declared under PVA.

Box 7: Include the total value of all goods that were imported in this period excluding any VAT. (this includes goods not declared under PVA)

If you have any further questions or would like to enquire about having your shipments declared under PVA please, contact us.