Sea freight rates spike again!

As we approach the halfway mark of 2021, continued disruption in the shipping industry is still keeping sea freight rates at unprecedented levels. Increased demand from importers; a lack of space on vessels; global port congestion; and a shortage of containers on the main routes have created the perfect storm.

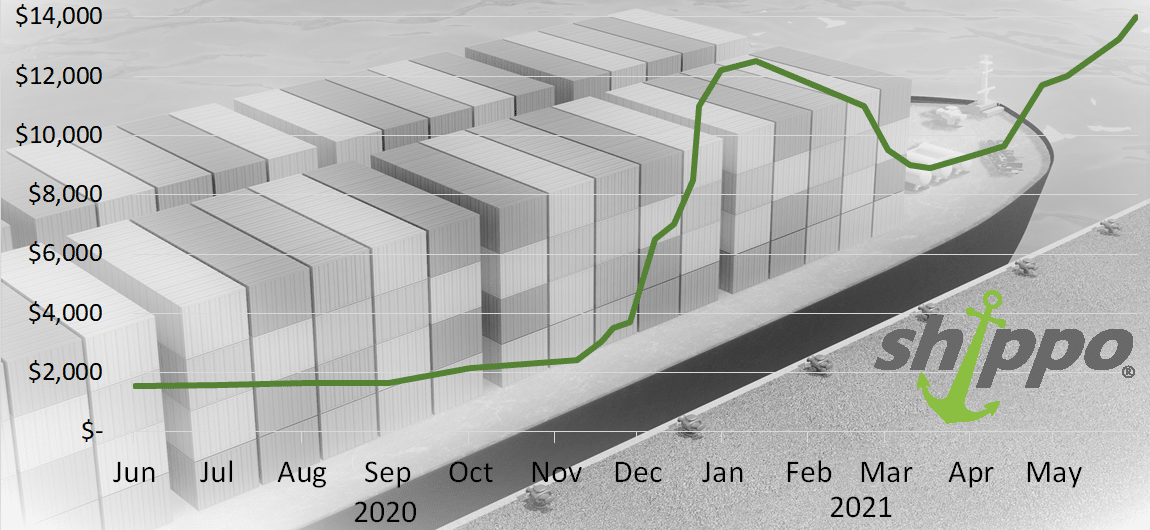

Analysis of the rates over the past 12 months (our graph, shows 40ft container rates from China to the UK, port to port) shows that the craziness we described at the turn of the year hasn’t subsided as expected. This is mainly due to the knock on effect of the Suez Canal fiasco at the end of March. When the Ever Given became lodged, a huge number of vessels and containers found themselves in the wrong part of the world. Once released, already congested ports and waterways were put under further strain as the vessels all descended at once.

The graphic shows that the industry was starting to recover. Rates were starting to reduce following Chinese New Year in February. In short, the Ever Given put pay to that. Despite the increased demand, shipping lines are having to miss out ports or change their planned schedules as they struggle to get their vessels back on track. This is exacerbating the problem as the lack of space on vessels is effectively creating a bidding war which leaves importers not only fighting for a “reasonable” cost but also space to actually ship their container.

Current and future rates

If you’re planning to import (from FOB China to you in the UK) over the coming month or so, you may wish to use the below rates as a guide, however these could be more or less depending on the exact details:

- 1.0cbm – approx. £450 + UK Duty & VAT

- 2.5cbm – approx. £750 + UK Duty & VAT

- 5.0cbm – approx. £1350 + UK Duty & VAT

- 10cbm – approx. £2500 + UK Duty & VAT

- 20ft Container – approx. £6000 + UK Duty & VAT

- 40ft Container – approx. £12000 + UK Duty & VAT

I’ve called Mystic Meg but she was unavailable for comment as to where the rates will be moving forward so we’ll have to resort to market “intelligence”. The current rates could be in place at either these levels or something similar until after Chinese New Year in February 2022. This is because there will only be a short window between the shipping lines being able to bring equipment back to their expected locations and the start of the peak season in the lead up to Christmas. There could be reductions in July and August but expect these to be modest rather than a return to the rates of old.

What is Shippo doing differently?

I think I can speak for all of us here when I say that the past 6 months or so have been a real challenge. I’ve seen and heard every one of our advisors battling to secure space on vessels from China for customers. It’s not been easy.

As of January 2021, we have taken a business decision to politely decline all requests from potential new customers who want to use our service to ship full container loads. We don’t think it’s fair on our existing customers that we add more containers into an already challenging fight for space. So far in 2020, we have turned away over 500 leads with full containers. This is a decision we’ve made to maintain the quality of our service and protect our brand values.

When it comes to our shared containers, from the major ports in China, we are booking space in advance. We have at least two containers per week from the major ports so (unless the shipping line cancels the vessel) our representatives in China are doing well to secure space and keep out service levels high.

We are fully aware of the damage that these rates are causing to all importers and their customers. If you ever want to talk through your shipping plans, booking, the rates, delays or get a market update, please don’t hesitate to get in touch.