This content was reviewed for accuracy on 07/12/2023

We’ve spoken about UK Duties and Taxes a lot on this blog; they’re one of the largest costs in the importing process and, if you aren’t aware of them, they’re the ones that will catch you completely off-guard. (If you’re importing and you want to predict your UK Duties and Taxes, we have a free UK Duty calculator.)

However, for all the times we’ve spoken about Duties, we haven’t gone in-depth and explained one of the largest duties you can be hit with – anti-dumping duty. But what is Anti-Dumping Duty? Let’s find out.

-

What Is Anti-Dumping Duty?

‘Dumping’ is the process of unloading a huge number of goods into a foreign market at much lower than market value.

An anti-dumping duty is a higher tax added to certain products to allow the government to control and monitor the introduction of them into the market.

For example, a normal duty rating could be 3% – but an anti-dumping duty may be 37%. Anti-dumping tax is usually used on suspiciously cheap products. It is a way to protect the domestic market.

-

Why Do Anti-Dumping Duties Exist?

We’ve already touched on this, but anti-dumping duties are used as a way to protect domestic markets from products being “dumped” in them. The higher tax fee discourages massive floods of people from importing the product – and, for people that do import it, the product will need to be priced more expensively to make a profit because of the extra duty charges.

Anti-dumping duty is imposed on imports being ‘dumped’ in the UK and within the EU. ‘Dumping’ is when foreign exporters sell goods abroad at a price lower than their local market rate. They may do this in order to offload stock faster by exporting but can have a negative impact on the domestic markets of the importing country if not controlled.

This duty increases the cost to import particular products. The idea is to boost domestic trade on particular items that they feel need a push in the right direction or to maintain an existing domestic industry.

-

Products With An Anti-Dumping Duty

There are a few products that we have seen people import that have had some anti-dumping duties imposed for you to take a look into:

- Bikes

- Ceramic tiles

- Certain cold-rolled flat steel products

- Ironing Boards

- Mugs

- Pump trucks from China have a 70% duty!

This list is by no means a full list. However, there is a list of the most recently applied anti-dumping duty measures on the government website.

Check your item doesn’t have an anti-dumping duty before you import it – if it does we can certainly do some calculations to help you determine your costs.

-

How To Find If My Product Has An Anti-Dumping Duty

Now you know what Anti Dumping Duty is, you need to find out if your product has one applied.

To find out if your product has an anti-dumping duty, all you have to do is find its duty rating.

Many anti-dumping ratings will come with caveats, such as there’s only an anti-dumping duty on this product if it is imported from a certain place, so it’s worth taking a look to see if there’s any way to avoid them.

We’ve written a step-by-step guide to find your commodity code on the trade tariff that you can use to find your product’s duty rating, but let’s take a look at an example.

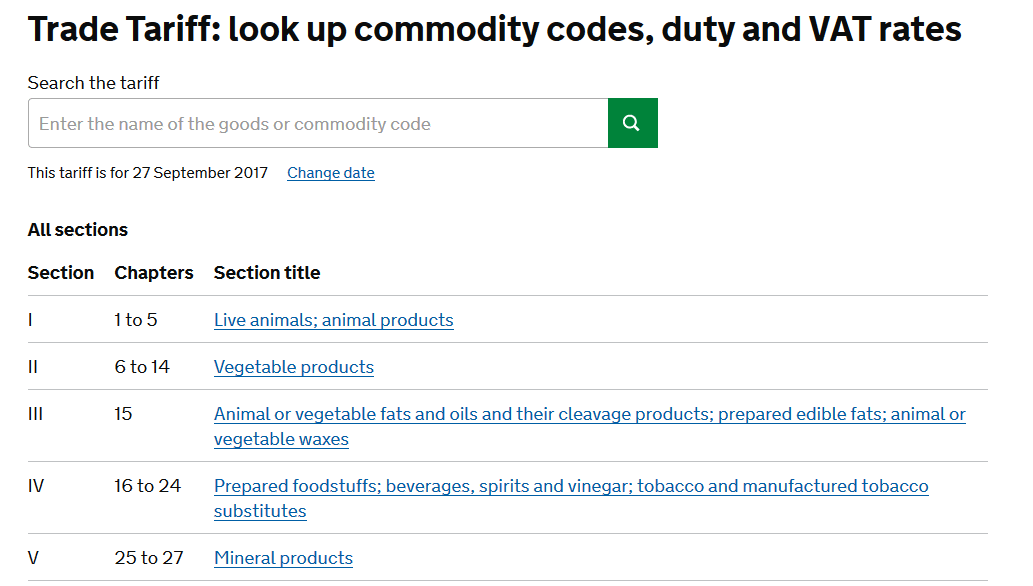

Let’s say you’re importing mosaic cubes and you want to check if they have an anti-dumping duty. First of all, you’ll need to open up the Trade Tariff.

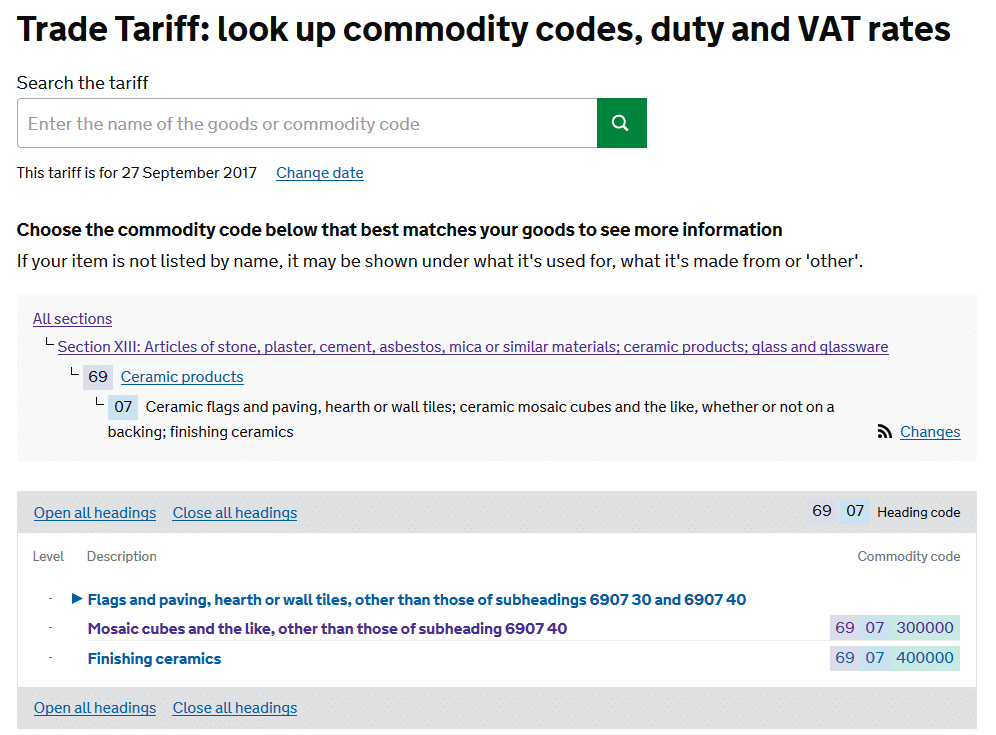

From there, you will need to find the correct section that your goods are classified under; in this example, we’re importing tiles and that is under section XIII. Once you’ve identified this, you then need to further specify the type of product you’re importing.

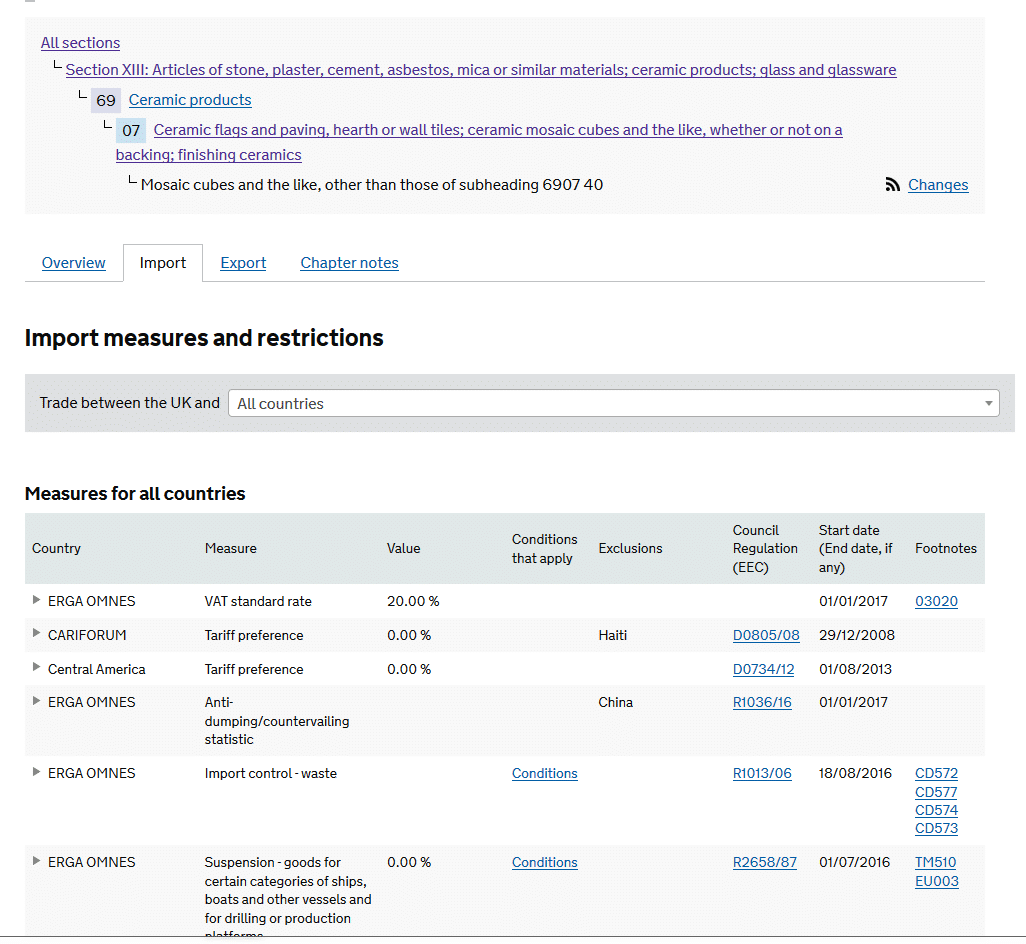

We would click on mosaic cubes and the like, as we’re importing mosaic cubes. Once you’ve selected your item, you will be brought to a different page containing all those item details; from there, click on the “import” tab and you’ll be shown all the duties information.

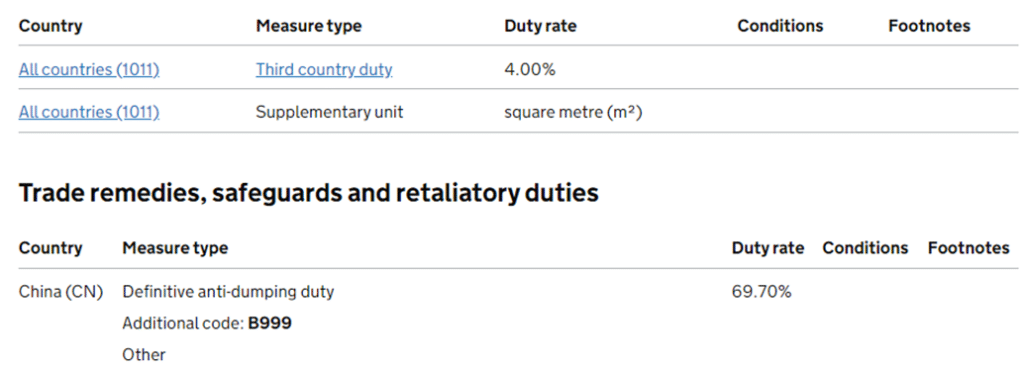

As you can see, there are a lot of conditions and different ratings – but what you need is to find yours. You can click on the ‘All countries’ drop-down to select the country that you are importing from.

For example, if you’re importing from China this will bring up the duties that apply specifically to imports from China:

If you’re importing mosaic cubes from China, there’s an anti-dumping duty of 69.7% on top of the 4% UK Duty! Ouch. You can see how this could be potentially devastating for a business if the fees catch you off guard – so make sure that you know your duty rating ahead of time.

Once you have found the commodity code and anti-dumping duty rating then you can certainly provide this to us as well as your commercial value and we can look to calculate this for you – we can also provide a shipping cost if you provide some further details.

Save

Save

Save

Save

Save

Save

-

How To Calculate Anti-Dumping Duties

If you’d like to know how to calculate these costs yourself…

Here’s how you’d establish an estimate (the exact figures will be very slightly less due to… actually… let’s not make this more complicated than it already is!):

To use round numbers for this example, we’ll assume the cost of the goods is £2000 and shipping cost is £500.

- First find the UK duty cost:

UK Duty = UK Duty Rating x (Purchase Cost + Freight Cost)

UK Duty = 4% of (£2000 + £500)

UK Duty = £100- Next establish your anti-dumping duty (ADD) cost:

ADD = Anti-Dumping Rating x (Purchase Cost + Freight Cost)

ADD = 69.7% of (£2000 + £500)

ADD = £1742.50- The final cost from HMRC will be the import VAT:

Import VAT = 20% of (Purchase Cost + Freight Cost + UK Duty + Anti-Dumping Duty)

Import VAT = 20% of (£2000 + £500 + £100 + £1742.50)

Import VAT = £868.50… so your costs to buy and import these goods would be:

Purchase Cost : £2000

Freight Cost : £500

UK Duty : £100

Anti-Dumping Duty : £1742.50

Import VAT : £868.50Without estimating the anti-dumping duties that’s around £2000 in extra costs that would have been unexpected when the goods landed in the UK.

We can certainly help with these calculations if you prefer.

Get In Touch

I would not use anyone else, I have used Shippo since October 2015 to import from Malaysia. Since the first communication they have been efficient, fast to reply, helpful, professional, trustworthy, they have helped me make my business successful and helped me no end when I started out. Highly recommend.Nicola HayesHopefully, you found this post helpful and are now aware of what anti-dumping duties are and why they exist. If you are importing goods and you want some help with freight solutions, feel free to contact us or grab a free quote.