When you import goods to the UK, you will have to pay UK Duties and Taxes to Customs before you can get your goods released to you. We’ve explained UK Duties and Taxes in full detail before, but today we’re going to help you identify how to find your product’s commodity code – one of the key factors that dictate how much duties you will pay.

-

What Is A Commodity Code?

A commodity code, also known as a HS code (Harmonized System Code) is a ten-digit number allocated to goods to classify imports.

Every product will fall under a specific code – this commodity code dictates your duty rating, as well as alerts you to any import or export restrictions. Your commodity code tells you:

- The duty and VAT ratings you’ll be charged for your goods

- If you can apply for a preferential duty rating (General System of Preference aka GSP)

- Whether your product requires an import license

- Whether anti-dumping duties apply

Commodity codes can be found on the Trade Tariff website.

-

Why Do I Need A Commodity Code?

When you import goods to the UK, you will be charged duty at customs. This charge is calculated as a percentage of your product’s value. Your duty rating directs how much you will have to pay Customs when you import; HMRC requires you to declare your product’s commodity code to them in order for them to classify your product and give it an accurate duty rating.

For this reason, it is imperative that you find your correct product code. If you declare your goods incorrectly, then your goods are liable to be held by customs and you’ll run into far larger costs and fines than what you would be paying if your goods were correctly declared.

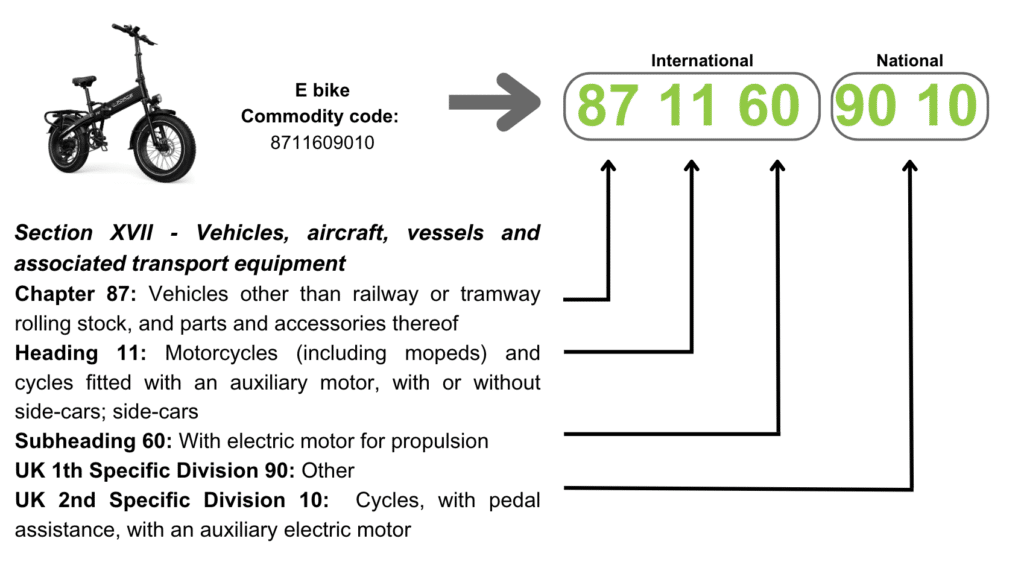

What Does The Commodity Code Mean?

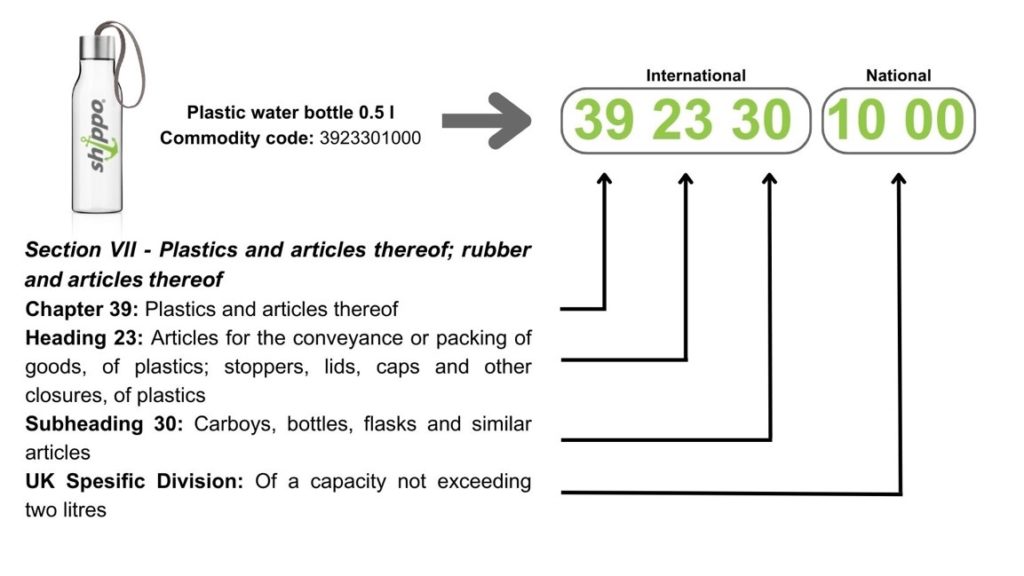

The first 6 digits of the code are used worldwide:

- The first 2 digits are the product group. Indicates the material, and how this is processed.

- The next 4 digits are the heading with more detailed specifications. E.g the type of product that the material makes up.

And the last 4 digits are related to the variations of the product and are specific to each country.

Here’s a breakdown for example, if you were importing a plastic water bottle:

This full code details to HMRC what the product is so they can see what UK duties and Taxes are applicable, as well as determining whether anti-dumping duties are applicable.

For example, an e-bike with an ‘electric motor for propulsion’ imported from China. comes under the subgroup “10” which means this will be applicable for definitive anti-dumping and countervailing duties.

As you can see below this code is currently (April/23) applicable for 62.10% in anti-dumping duty and 17.20% in countervailing duty.

Here’s our guide on how to find out whether your products are applicable for these extra charges.

-

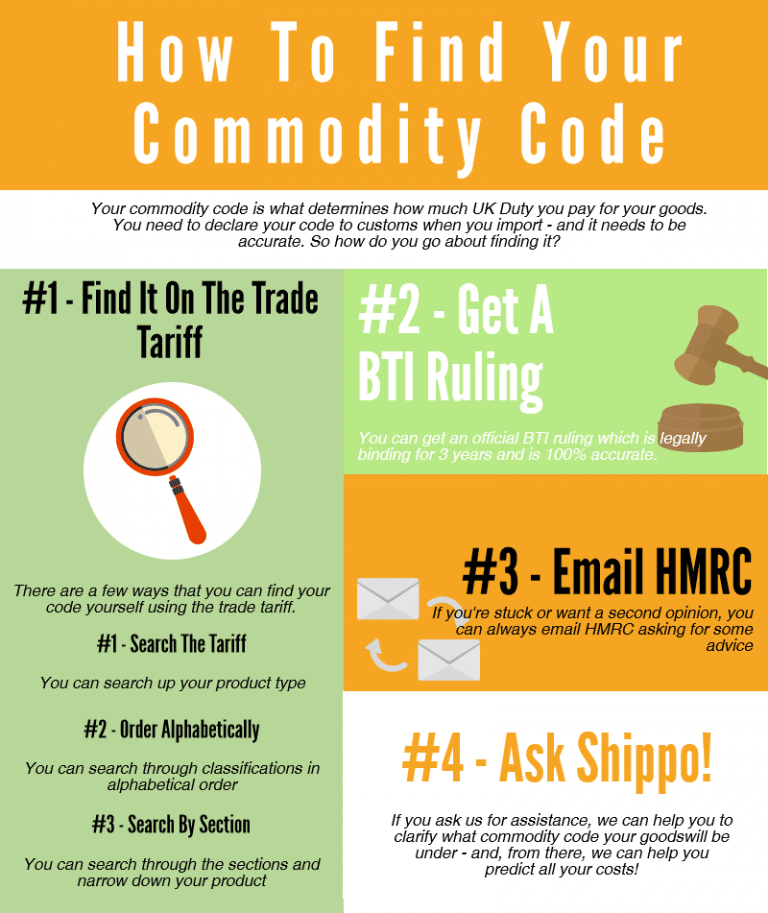

Finding Your Product’s Commodity Code

To start with, you can ask your supplier to let you know what code they are using to declare the goods to customs their end. This won’t give you the exact code to use but it should give you the first 4-6 digits that will narrow down your search through the minefield that is the trade tariff website!We have put together a step-by-step guide on how to navigate the trade tariff website here.

To efficiently select the full code, there are two ways you can go about this – you could ask someone to help you navigate through the Trade Tariff website, or you could contact HMRC with a description of your goods and they will be able to advise the code they deem appropriate – however, this is just their advice, if you require a legally binding decision you’ll need to apply here.

Get In Touch

We have just imported a container from China for the first time with Shippo. We were nervous about the process involved but Phoebe at Shippo was very helpful and the website is full of useful information. Delivery was done swiftly after arrival of the container and at the allocated time.Annie O'ConnorWe hope this guide to finding your product’s commodity code was useful. If you have any questions to are struggling, please feel free to contact us. You can also get a quote for shipping here.