Grab a cuppa because this post is very detailed but it’s worth taking the time to understand CIF/CFR risks and hidden costs so you don’t get stung when importing.

When importing, it is often the case that you will accept an overseas supplier’s offer to ship your goods. Initially, this will seem quick, cheap and easy, however, there are considerable hidden charges which will hit hard later in the process. Whilst at first you are paying only $50 you could later be saddled with a final cost of $700-750!

Below is a demonstration of the process so you are best prepared to prevent this.

**This is a real case; these invoices and emails are from a real customer of ours. These things really do happen – which is why we’re trying to prevent them. The customers name has been changed**

-

Case Study | Overview

Today we’re going to take you through a case study that perfectly demonstrates one of the most common and unfortunate situations we deal with in the importation business.

If you’re here, it’s because you’re thinking about importing, wondering about how much it should cost – and maybe even trying to align your supplier’s quoted costs with that figure in your head. Here’s the thing: there’s no shortcut. Whatever you’re importing, whenever you’re importing, from wherever you’re importing – it’s always going to cost you. The only difference is whether you pay that price up-front where you can budget and plan for it, or if it’s slapped on you as a surprise hidden fee when you try to collect your items.

Now, we understand that it’s hard to factor in risks when they’re simply that – a risk. A chance. It’s probably not going to happen to you – and, if it does, what’s an extra £50 charge if you just saved £250?

But what if it wasn’t £50? What if you were charged double the original quote? What if you were charged more than you paid for your goods just to get them released to you? Then you’d seriously rethink this “bargain” arrangement, right? We here at Shippo have unfortunately seen and heard this story too many times – when it’s too late to help. So, before you make the same mistake, read this case study – and, if you think your supplier could be trying to do the same to you, contact us for alternatives.Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

-

CIF/CRF Case Study | Detailed

John imported some products from China for a new business. As a first-time importer, he wasn’t really sure what to expect from importing in terms of costs and process. When his supplier offered him delivery to his chosen UK port John jumped at the chance. It was only $50 and he didn’t have to do anything other than pay the UK costs when it lands! It sounded like a great deal and he was relieved that the process seems so much easier than he first thought it was going to be.

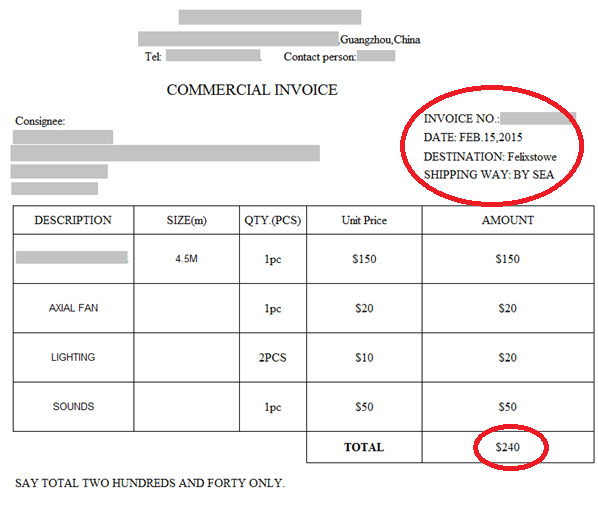

This is John’s invoice for his purchases from his supplier – the total is only $240. This is for the cost of his goods and he pays his supplier $50 extra for the shipping. John was very pleased with this and all he had to do was sit back with a cup of tea and wait for his goods to arrive in the UK.

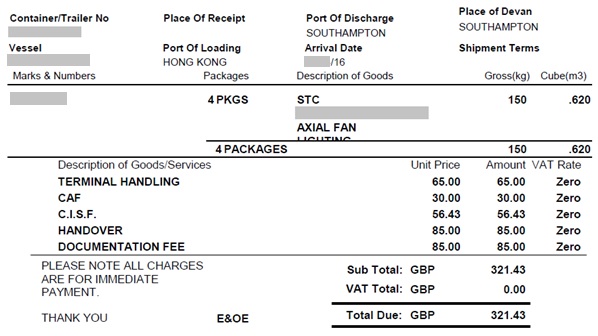

When John’s goods were a week away from landing, he was pretty excited to collect them . . . until he receives a notice of arrival from a company he’s never heard of along with a pretty large invoice. The one full of hidden charges he wasn’t ready for.

This invoice came to £321 – which is around $426. This unexpected list of charges cost John nearly double what he paid for his goods. He was angry and disappointed but the company said that he can’t have his goods unless he pays the invoice – but at least then he has his goods, right?

Wrong.

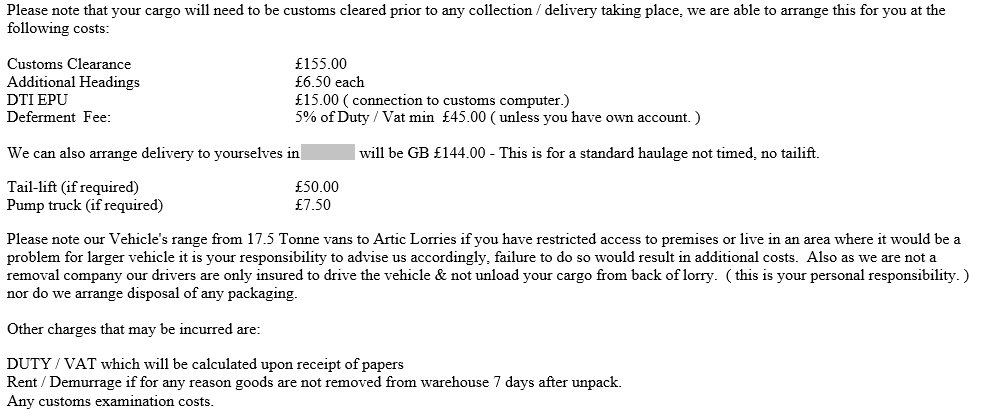

John was then told that he also had to pay customs clearance and delivery on top of these charges. Here’s what he was told those charges were:

This is the email from his shipping company detailing how much he has to pay on top of the other invoice. At this point, John hadn’t even cleared customs yet – which would cost him an extra £155 plus £45 for Duty/VAT deferment (the cost for the shipping company to pay HMRC before billing John the UK Duty & VAT)!

John lived too far from the port where the goods landed to collect them himself and used the shipping company for delivery (£144). Fortunately, he had a few helpful friends who helped him to unload the delivery from the truck or he’d have had to pay an extra £57.50 on top of that for a tail-lift delivery with a pump truck to unload!

Here is the sum total of what he had to pay to get his goods to him. (Based on minimum charges and no extras – although buyers will often need to purchase a tail lift and pump truck to unload their goods as the drivers will not help you):

John’s goods cost him $240 or around £185. The total for the shipping was £718 (plus UK Duty & VAT):

- Shipping to UK – £38 ($50)

- Unexpected UK Costs – £321

- Clearance & Delivery – £359 (£155 + £15 + £45 + £144)

£718 for goods worth £181! That’s almost 4 times as much money!… before he’s paid UK Duty & VAT to HMRC.

Imagine being a first-time importer – or the owner of a small business – and budgeting to spend around £450 on start-up stock, but having to pay over £900. That could be a potentially devastating amount of money to lose and would cripple most first-timers.

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

-

The Cost of Importing & Hidden Fees

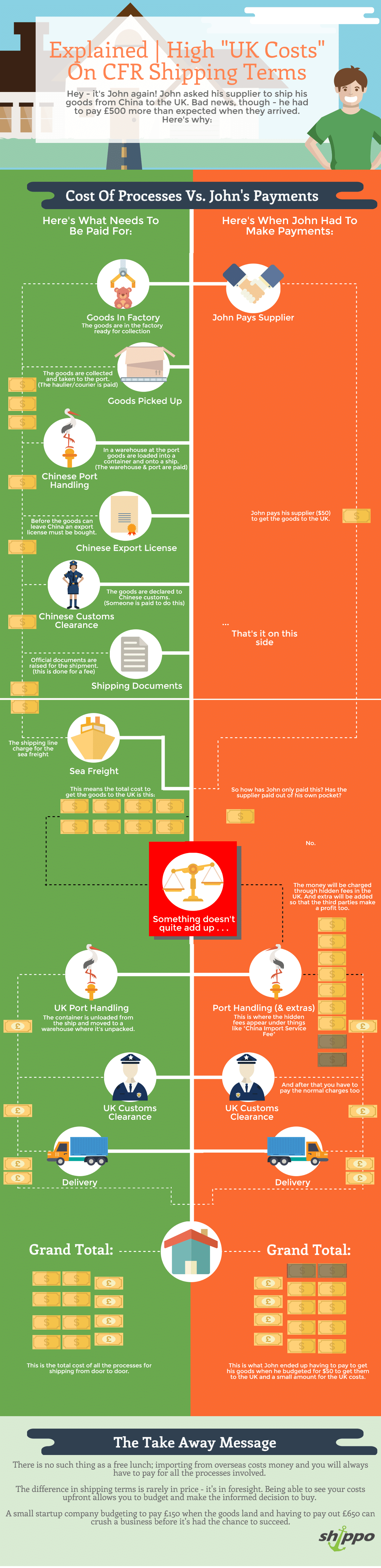

Before we walk you through the hidden fees and how they come about, let us explain the shipping process. A lot of the confusion comes from thinking that there’s a bargain to be had whereas, in reality, everyone along the way has to be paid for doing their job! Here’s an overview of what people are being paid for throughout the process against when the costs were paid by John when his supplier shipped his goods to the UK:

These are the steps in the importing process:

- The supplier packages the goods in the factory.

- A courier/haulier picks the goods up and takes them to the port.

- For shared containers, in a warehouse at the port, the goods are loaded into a container (by hand or forklift) and then the container loaded onto a ship (by crane).

- A Chinese Export License must be bought to allow the goods to leave China.

- The goods then need to be declared to Chinese Customs; someone is paid to do this.

- To ship the goods, official documents need to be raised. This is done for a fee.

- Once on board the ship, the cost of sea freight is to cover the sea transportation from port to port.

- Now in the UK, the goods are unloaded from the ship (by crane) to be transferred into a warehouse (by truck) where the container is unpacked (by hand or fork-lift). The port and warehouse take care of this, for a fee.

- The goods then need to be declared to UK Customs by a specialist.

- Finally, a haulier picks up your goods and delivers them to your chosen location.

Now that you hopefully understand the process, let us reiterate: there is no way to avoid paying someone to do their job!

You can see all the steps and services needed just to get your goods out of the factory and onto a ship – not to mention across the sea to you. So how could you possibly get all of that for $50? It’s just not possible.

What you can see from this process, is why the extra is tacked on at the end – because, regardless of how attractive the supplier wants to make the shipping number appear to the prospective buyer, the third party services not only want, but need to get paid. As you can see, John’s original payment didn’t even cover the goods being picked up from the factory – which means all of those costs build up and need to go somewhere.

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

-

CIF/CRF Hidden Fees Explained

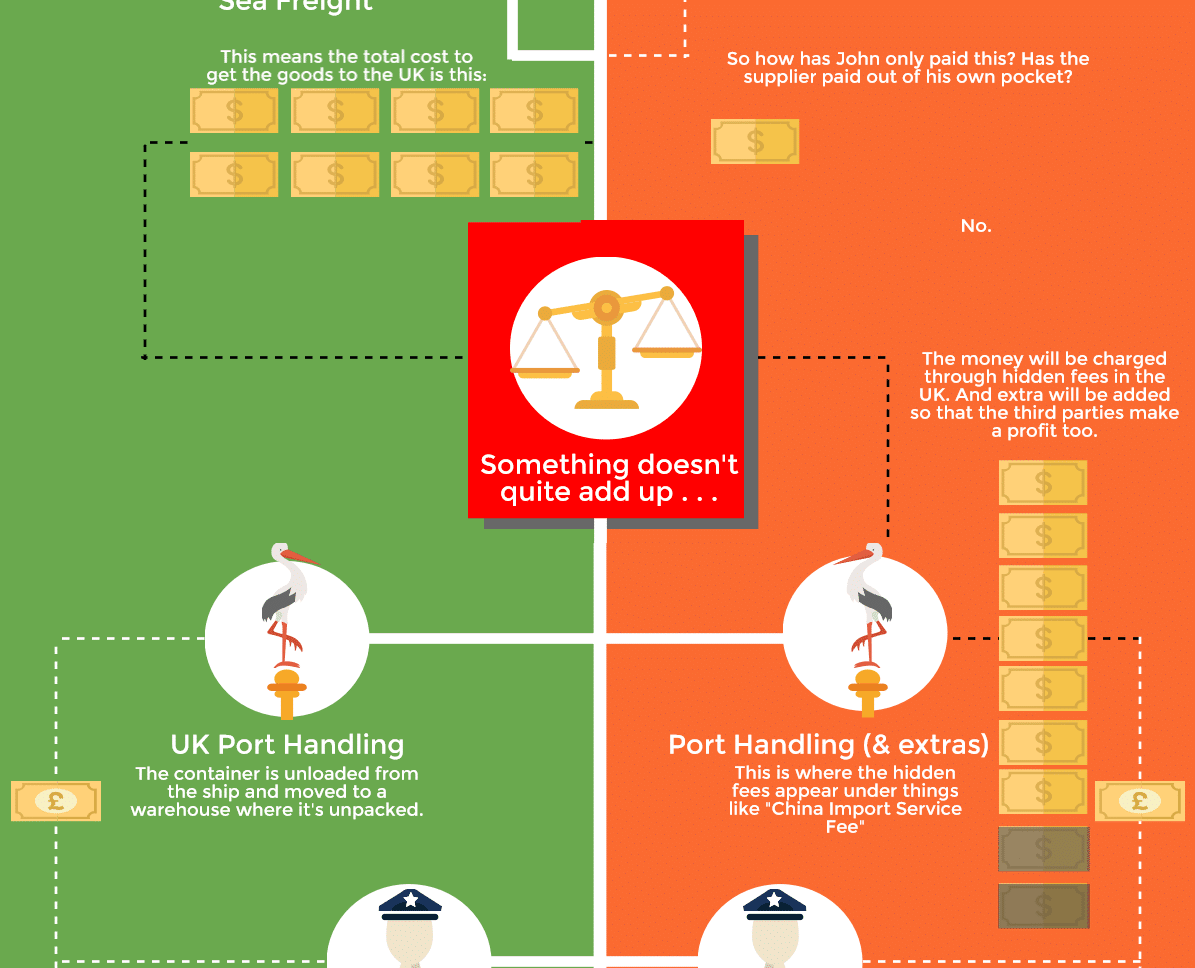

To cut a (very) long story short, hidden fees are slapped on you because of ineffective cost management. We’ve seen the process; we’ve seen how much needs to get paid – what we haven’t seen is anybody actually paying it. Alongside the steps in the process infographic, we also showed you the distribution of money.

For the purpose of this explanation, we’re operating under the assumption that each dollar bill is worth $50 and each pound note is worth £50. As you can see, by the time John’s goods were on the ship to the UK the fee of 8 bills ($400) had collated on the side of the process for the total costs of the services provided, but John had still only paid his supplier one ($50).

Does John’s supplier know about this?

- John’s supplier was probably only charged $50 dollars to get the freight to the UK too. In situations like this, it isn’t the supplier vs the buyer – the supplier often has no idea of the extra costs either.

- Like UK importers, the supplier will use a freight forwarding company to take care of their goods. This is for the same reason that UK importers would; to make the process as simple and easy as possible. The same way that as a customer you just want the goods here, the supplier just want to get the goods to you.

- The supplier, like John, pays a one-time fee to the Chinese freight forwarder and it becomes the forwarder’s responsibility to then take care of the entire process. The freight forwarders only charge them $50 – so that is what they charge John. From here on out, the goods are no longer in the supplier’s control and the supplier has no influence over the costs.

- In their minds, this is the end of it – they’ve paid to get the goods shipped to John and John’s paid them that money. Everyone should be happy all round; onto the next customer.

How does the supplier only need to pay $50?

- The Chinese freight forwarding company need to ship cargo to stay in business.

- To make sure they always have cargo to ship, they will often offer their services for a cheap rate. They sometimes even offer their services to the supplier for free – or pay the suppliers to use them! This means that the supplier can offer a low rate to the customer because the low rate is all the supplier will need to pay.

- The issue here is that the Chinese forwarders then immediately begin the shipment working at a loss – which they will need to make back. However, they’re also a business, which means that they don’t just want to make their process charge back; they also want to make a profit. Despite the attractive initial price, the costs in the process still add up . . . this means the Chinese freight company need to make their money back somehow.

And we’ve found our hidden fees!

- To make their money back – and their profit – the Chinese freight forwarders charge you hidden fees in the UK. The most common example of this are C.I.S.F. (China Import Service Fees) and hugely inflated terminal handling costs.

- This means the hidden costs don’t actually come from your supplier. They may not even know about them.

What’s the takeaway?

The takeaway message is the same as usual when something seems too good to be true…

The idea of considering C.I.S.F. a remuneration fee from the Chinese shipping company instead of a hidden cost is a good way to look at the situation. It’s a hidden fee because you weren’t expecting to pay it; however, you were – and are – always going to. It’s not about avoiding these costs, it’s about being aware of them upfront and being able to effectively manage them. Although you do have to pay the charges for all of these services, you don’t have to pay the, at times, extortionate mark-up charges that get dumped on you as a hidden fee.

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

Save

-

Avoiding Hidden Costs

Are you buying goods from overseas? Is your supplier offering to ship them to a UK port of your choice for you? Have you found yourself Googling “where is the nearest port to me?” and stumbled across this page? If so, thank your lucky stars – because we’re about to stop you from possibly making a BIG mistake.

Hopefully, there’s something causing you to hesitate – you’ve got a sense niggling at you, saying: “I don’t know if this price is quite right,”; “I’m not sure how such a low price is possible,”; you may even be starting to wonder “how much should it cost to import to the UK from overseas?”. Maybe you’re importing goods from China – and being told it will only cost you $50 to get them to the UK. Does something seem a little too good to be true?

Hard truth time: it probably is. If your supplier is offering you an attractively low price to ship your items, then you should be cautious.

This uncertainty isn’t always there when importing goods from China…

Have we spoken about Shipping Terms yet? No?

What Are Shipping Terms?

Shipping terms (also called Incoterms) are essentially are a set of instructions detailing the responsibilities of the Shipper (your supplier) and the Consignee (you; the buyer) in getting your goods to your door. There are a number of different shipping terms allowing responsibilities to be split differently depending on the situation. The three main shipping terms that you’ll have to know as an importer are CIF (or CFR), FOB and EXW.CIF (CFR) – Cost, Insurance and Freight – The seller pays for everything up to and including the freight to a named destination port, the first charge to the buyer is the terminal handling at the destination port.FOB – Free On Board – The seller’s responsibilities include everything up to getting the goods loaded onto the vessel at the agreed outbound port. The first charge to the buyer is the freight costs and then they are responsible for all the costs to get the goods to their final destination.EXW – Ex Works – The only obligation the seller has, is to make the goods available for collection. The buyer pays all the costs to get the goods from the supplier to the final destination.We have a glossary explaining the different Incoterms and their responsibilities here.You can use shipping terms to your advantage to avoid these nasty hidden costs. You can choose shipping terms to suit your individual needs and expertise in importing so that you can manage everything that goes on with your goods. The one we would recommend to most first time importers is definitely FOB shipping terms. If you’ve found your supplier on Alibaba then you may have seen that they ask their suppliers to provide an “FOB Price” because they feel that these are the most effective terms to use too.

FOB (Free on Board) Shipping Terms

Using FOB shipping terms is the easiestway to keep your costs under control. They propose an even split of responsibilities and obligations between the supplier and the buyer and you become responsible for your goods much earlier in the process than on CIF/CFR terms. All you’ll need is the FOB price from your supplier for the goods, an FOB shipping cost and a UK Duty and VAT estimate (we have a calculator where you can work that out here)

When buying on FOB terms, buyers (importers) are responsible for:

- Freight costs

- Port handling at destination

- Customs clearance at destination

- Delivery to their final location

This may sound daunting to a first time importer, but the only extra responsibility you take on is the duty of covering freight costs. Which is easy as pie – you just hire a company like us (freight forwarders), we give you an upfront quote and we can have it delivered to your front door! With absolutely no hidden costs. For a full description of what FOB Shipping terms are, read our glossary post here!

One of the top tips we can give you is to check with your supplier before you buy. Ask them for the prices of the shipping on FOB and getting them to the UK for you (CIF) and see if there’s a difference. If it costs them more to get your goods to their local port (FOB) than it does to ship them across the world to you (CIF) then you know that something doesn’t quite add up.

Save

Save

Save

Save

Save

Save

Save

Save

Save

-

What To Look Out For? CIF/CFR

From everything we’ve already told you about shipping terms, you’re probably wondering about where shipping terms come into this kind of transaction. Well, when you choose this method, unbeknownst to you, you actually are operating under shipping terms – just not explicitly stated ones.

The shipping terms CIF (Cost, Insurance, Freight) and CFR (Cost and Freight) are what this type of shipping method works under.

You now know that this is a not just possible but likely scenario. Let’s break down the steps and explain to you where things start going wrong and why. We’re going to walk you through this case study so that you know how to avoid making the same mistake that John did.

The main thing wrong with this is “SHIPPING WAY: BY SEA”. If your goods are being shipped via sea freight, then your supplier needs to clearly specify what shipping terms you are under, or invite you to discuss and negotiate what terms you want to operate using. This is so that you can avoid being blindsided. As soon as you realise your goods are being shipped via sea freight and you haven’t had a discussion about shipping terms, raise a red flag.

Save

Save

Save

Save

And that is all you need to know. As soon as you see the word sea, think “shipping terms” – and think FOB (or Exworks)!

Save

Save

Save

Save

Save

Save

-

Contact Shippo

Phew! We told you it was a long one!

We hope you found this post informative. Don’t end up like John; know all of your costs upfront before going in. If you found this post helpful, share it so other people can benefit too!

If you have any further questions just contact us and we’ll be happy to help!

Our go-to end-to-end worldwide shipping solution. Excellent service from Zac and the team who go out of their way to make things as smooth as the seas allow – Kudos to Shippo!Daniel Newhouse